Is An Alternative Business Loan Right For Your Business ?

Sometimes even the most lucrative businesses need funding, and sometimes that funding is hard to come by. But, why? Why do some businesses need an alternative small business loan source instead of the regular options? Well, the answers may be surprising, but they can help you better understand the mainstream business funding industry.

Sometimes even the most lucrative businesses need funding, and sometimes that funding is hard to come by. But, why? Why do some businesses need an alternative small business loan source instead of the regular options? Well, the answers may be surprising, but they can help you better understand the mainstream business funding industry.

Poor Credit History: When reviewing a business loan application, a credit history is one of the first things that lenders look at. A good credit score shows that a business owner has a solid handle on their personal and business credit, which is what every lender likes to see. On the flip-side, a poor credit score doesn’t instill confidence in lenders. A business owner with a sub-par credit rating might not be able to meet the financial obligations that are set forth in the loan agreement.

Cash-Flow Issues: Entrepreneurs start businesses to make money. Cash flow is …

Is An Alternative Business Loan Right For Your Business ? READ MORE

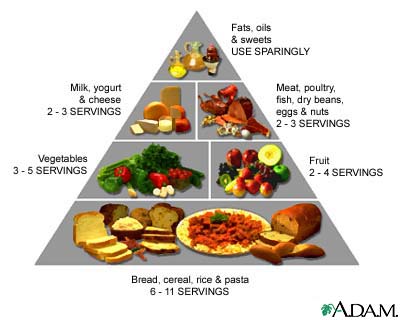

Confident, eating nicely can be tough — family schedules are hectic and grab-and-go convenience meals is readily readily available. That depends on a few components, like your body sort, your metabolism, and how diligent you are about eating healthy. Vegetables and legumes – raw or cooked vegetables can be applied as a snack food or as a aspect of lunch and dinner. When you join you are offered a booklet which lists all foods and explains how to go about optimising what you eat and if you are unsure about something your consultant is on hand to guide you. The 7 Day GM Diet regime Plan is a fad diet regime, in that by definition it eliminates a single or far more of the important meals groups or recommends the consumption of a distinct food group in excess at the expense of a further. If you have an urge to …

Confident, eating nicely can be tough — family schedules are hectic and grab-and-go convenience meals is readily readily available. That depends on a few components, like your body sort, your metabolism, and how diligent you are about eating healthy. Vegetables and legumes – raw or cooked vegetables can be applied as a snack food or as a aspect of lunch and dinner. When you join you are offered a booklet which lists all foods and explains how to go about optimising what you eat and if you are unsure about something your consultant is on hand to guide you. The 7 Day GM Diet regime Plan is a fad diet regime, in that by definition it eliminates a single or far more of the important meals groups or recommends the consumption of a distinct food group in excess at the expense of a further. If you have an urge to …

Believe it or not, most natural cleaning products are not really that sturdy. I saw on the web that people have been reusing parmesan cheese or economy sized spice jars that have that sprinkle spout best, but the mason jars work terrific too. One particular bit of warning even though- I noticed a commenter already warned against employing vinegar on all-natural stone.

Believe it or not, most natural cleaning products are not really that sturdy. I saw on the web that people have been reusing parmesan cheese or economy sized spice jars that have that sprinkle spout best, but the mason jars work terrific too. One particular bit of warning even though- I noticed a commenter already warned against employing vinegar on all-natural stone.